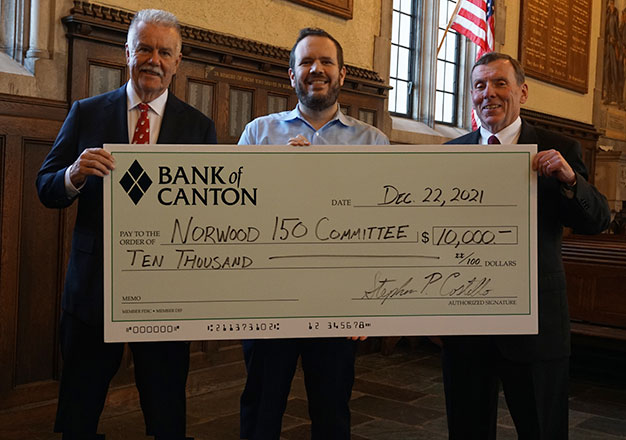

Norwood 150 Steering Committee members Michael Thornton (left) and Norwood General Manager Tony Mazzucco (center) receive Bank of Canton’s $10,000 donation from the bank’s president and CEO, Stephen P. Costello.

CANTON, Mass. (January 20, 2022) – Bank of Canton has made a $10,000 cash donation to Norwood 150, a community-based civic organization established to engage families, schools, and local businesses in celebrating Norwood’s 150-year history. The Norwood 150 Committee comprises dozens of volunteers charged with developing and orchestrating a wide range of year-long programming to mark the town’s anniversary.

“We’re very grateful to Bank of Canton for becoming a Gold Sponsor of Norwood 150,” said Tony Mazzucco, Norwood’s general manager & Norwood 150 Publicity Subcommittee member. “The bank’s generosity will help fund many of the events we have scheduled throughout the year.”

Norwood 150’s programming includes book discussions and speakers through the Norwood Historical Society, ice skating events, town trivia night, and the dedication of a new Vietnam Veterans’ Memorial, among other events.

“Norwood is a town rich in history and culture,” said Stephen P. Costello, president and CEO of Bank of Canton and lifelong Norwood resident. “Norwood 150 is bringing the entire community together to celebrate the town’s unique past and its promising future. Bank of Canton is very proud to have been a part of that history, and we are pleased to help support and participate in this year’s events.”

In addition to Bank of Canton’s financial support, its employees have served the town in leadership capacities as well, including Mr. Costello, who chairs the town’s Economic Development Committee, and mortgage lender Thomas F. Maloney, who chairs the Board of Selectman and is a member of the Norwood 150 Steering Committee.

About Bank of Canton

Established in 1835, Bank of Canton is a Massachusetts-chartered mutual savings bank that offers its consumer, business and government banking customers access to a full array of deposit, loan, investment and convenience service options. As a mutual savings bank, the bank has no stockholders and acts exclusively in the best interests of its customers and communities. The bank lends throughout Massachusetts, and has branches in Canton, Quincy and Randolph and a mortgage center in Auburn. All deposits are fully insured between the Federal Deposit Insurance Corporation (FDIC) and the Depositors Insurance Fund (DIF). For more information, visit www.ibankcanton.com. Member FDIC. Member DIF. Equal Housing Lender. NMLS #408169.

###